SEBI’s Surveillance Frameworks

An overview of Enhanced (ESM), Additional (ASM), and Graded (GSM) Surveillance Measures to protect investor interests.

Purpose of Frameworks

To protect investor interests, promote market development, and regulate the securities market in response to a dynamic environment, retail growth, and new technologies.

Surveillance Types

- Graded (GSM): Targets fundamentally weak companies where market valuation seems disconnected from business performance, aiming to curb price rigging.

- Additional (ASM): A market-driven tool responding to abnormal trading like extreme volatility or high client concentration, regardless of company fundamentals.

- Enhanced (ESM): A high-intensity framework focused exclusively on the vulnerable micro-cap segment to prevent manipulation and speculation.

Stock Classification

Surveillance measures are translated into tangible trading rules through stock classifications. BSE uses Groups (‘A’, ‘B’, ‘T’, ‘Z’), and NSE uses Series Codes (‘EQ’, ‘BE’, ‘SM’, ‘ST’). A change in group/series signals new trading rules, such as intraday trading prohibitions, higher margins, and reduced liquidity.

Enhanced Surveillance Measure (ESM)

A magnifying glass on micro-caps, this is the most stringent framework addressing risks in companies with a Market Cap < ₹1,000 crore.

Criteria

Triggered by extreme price movements alone. Key checks include:

- High to Low Relative Price Variation: Stock’s price movement is greater than all stocks’ price movement under ₹1,000 crore market cap (measured over 3, 6, or 12 months).

- High to Low Absolute Price Variation: Exceeds a threshold (e.g., >75% in 3 months, >100% in 6 months, >150% in 12 months).

- Close-to-Close Relative Price Variation: Stock’s price movement is greater than all stocks’ price movement under ₹1,000 crore market cap (measured over 3, 6, or 12 months).

- Close-to-Close Absolute Price Variation: Exceeds a threshold (e.g., >50% in 3 months, >75% in 6 months, >100% in 12 months).

Process

Stage I

- Trade-to-Trade (T+T) Settlement

- 100% Margin

- Price Band of 5% (or 2% if already lower)

Stage II

- Triggered by >15% price variation in 5 days or >30% in a month with high P/E

- Price Band reduced to 2%

- Periodic Call Auction Mechanism

Review

Securities remain in ESM for a minimum of 90 days (one month in Stage II). After 90 days, a weekly review is conducted for potential removal if criteria are no longer met.

Additional Surveillance Measure (ASM)

A market-driven tool to curb excessive speculation triggered by unusual price movements, volatility, and concentrated trading.

Long-Term ASM

Criteria

- High-Low Price Comparison: Significant difference between high and low prices over a 3-month period (benchmarked against Nifty 50’s variation + Beta).

- Close-to-Close Price Comparison: Substantial price changes over a 60 to 365-day period (+ Beta-adjusted Index Price Changes).

- Client Concentration: Top 25 clients account for 30% or more of the combined trading volume on BSE & NSE.

- Market Capitalization: Market cap is greater than ₹500 crore.

- Volume and Delivery Metrics: Sharp increase in monthly trading volume compared to previous months, combined with a low delivery percentage.

Process

Short-Term ASM

Criteria

Targets securities with immediate, sharp movements and concentration over short periods (5 to 15 trading days). Typically involves significant Close-to-Close Price Variation combined with high Client Concentration.

Process

Review

- LT-ASM: Reviewed weekly after 60 days of inclusion.

- ST-ASM: Reviewed after 5 or 15 trading days.

Graded Surveillance Measure (GSM)

Aligns stock price with fundamentals, identifying situations where prices rise despite weak business metrics, a potential sign of “pump and dump” schemes.

Criteria

Key parameters include:

- Net Worth is less than ₹10 crores.

- Net Fixed Assets + CWIP is less than ₹25 crores.

- Valuation Metrics: P/E Ratio is > 2 times the benchmark index OR the P/E is negative. A secondary check is performed where P/B is > 2 times the benchmark’s P/B OR P/B is negative.

Exclusions

- Public Sector Enterprises and their subsidiaries.

- Stocks in their first year after IPO.

- Stocks paying dividends for the last 3 consecutive years.

- Stocks with DII/FII holding > 10%.

Review

- Quarterly Review: To assess if a security can be moved to a lower stage of surveillance.

- Half-Yearly Review: To assess if a security can be completely removed from the GSM framework.

Process after Identification

Identified stocks are moved into different stages with increasing restrictions.

BSE Framework

- Stage I: T2T Settlement, 5% Price Band.

- Stage II: T2T Settlement, 100% Margin, 5% Price Band.

- Stage III: Trade once/week, 100% Margin.

- Stage IV: Trade once/week, 200% Margin.

- Stage V: Trade once/month, 200% Margin.

- Stage VI: Trade once/week, 200% Margin, No upward movement.

NSE Framework

- Stage I: 100% Margin, 5% Price Band.

- Stage II: T2T Settlement, 50% Margin, 5% Price Band.

- Stage III: Trade once/week, 100% Margin.

- Stage IV: Trade once/week, 100% Margin, No upward movement.

BSE/NSE Stock Classification

Exchanges use specific groups (BSE) and series (NSE) to visibly classify stocks under surveillance, enforcing trading rules directly on their platforms.

BSE Groupings

- Group A: Blue-chip, actively traded, highly liquid, and compliant companies.

- Group T: Compulsory “Trade-to-Trade” (T2T) settlement (no intraday). Result of GSM or LT-ASM action.

- Group Z: A red flag for non-compliant companies.

- Group B: Includes companies not in other groups.

NSE Series

- ‘EQ’ (Equity): Normal settlement, eligible for delivery and intraday.

- ‘BE’ (Book Entry): T2T segment (no intraday) as a result of surveillance action.

- ‘SM’: Transactions must be in pre-defined “lot sizes”.

- ‘ST’: SME stocks with T2T settlement.

Price Bands & Moving Out of Surveillance

A consolidated view of the price band restrictions and the review process for exiting each surveillance framework.

Enhanced Surveillance Measure (ESM)

Price Band Impact

- Stage I: Price band of 5% (or 2% if already at that level).

- Stage II: Price band is further restricted to 2%.

Review & Exit Process

- Securities must remain in ESM for a minimum of 90 days.

- If in Stage II, must stay for a minimum of 1 month.

- After the minimum period, a weekly review is conducted. The stock is moved out if it no longer meets the ESM criteria.

Additional Surveillance Measure (ASM)

Price Band Impact (Long-Term ASM)

- Stage II: Reduced to the next lower level (e.g., 20% to 10%).

- Stage III: Reduced again to the next level (e.g., 10% to 5%).

- Stage IV: Price band is set at 5%.

Review & Exit Process

- Long-Term (LT-ASM): Reviewed weekly after 60 days of inclusion.

- Short-Term (ST-ASM): Reviewed after 5 or 15 trading days.

Graded Surveillance Measure (GSM)

Price Band Impact

- BSE/NSE (Stage I/II): Price band of 5% or lower.

Review & Exit Process

- Quarterly Review: To assess if a security can be moved to a lower stage.

- Half-Yearly Review: To determine if a security can be completely removed from the GSM framework.

Other Information

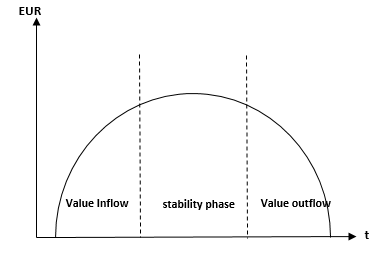

Impact on Liquidity

When a stock is moved to a restrictive category like T2T settlement, liquidity often evaporates, making it harder for investors to buy or sell large quantities without affecting the stock price.

Broker “Nudge” Notifications

Brokers are now mandated by exchanges to provide a “nudge” or a pop-up notification during order placement for any security under surveillance. This ensures investors are explicitly aware of the associated risks and restrictions before executing a trade.